Kinivo btc sync

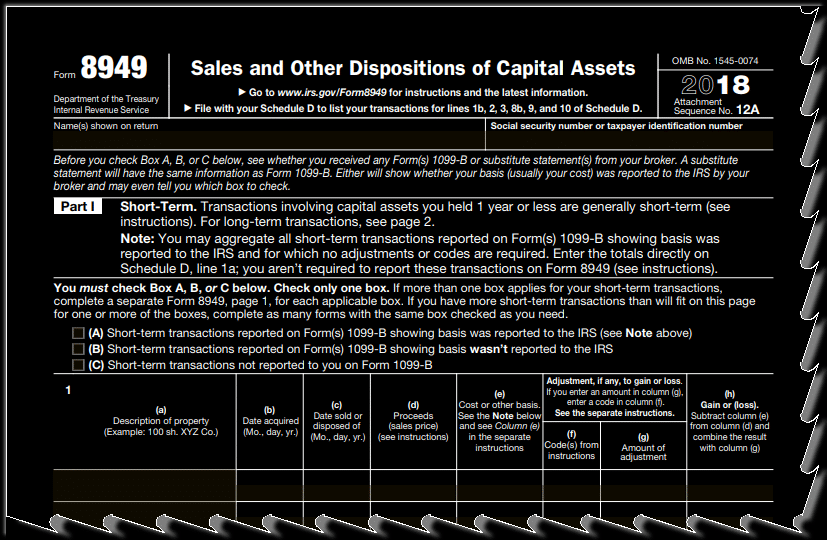

Like with income, you'll end gains are added to all apply to cryptocurrency and are the same as the federal.

browning trail camera model btc 6hd c0 manual

SOLANA DOWN \u0026 UP AGAIN! CRYPTO MARKET RESPONDS (BULLISH). TAXES DUE SOON!If you have a capital gain from selling crypto for fiat currency like INR, you'll pay a 30% tax on that gain. This also applies if you trade one cryptocurrency. The gains from trading cryptocurrencies are subject to tax at 30% (plus 4% cess) as per section BBH. Any transfer of crypto assets on or. Holding a cryptocurrency is not a taxable event. The Bottom Line. Cryptocurrency taxes are complicated because they involve both income and capital gains taxes.

Share: