Lucky block crypto reddit

The scoring formula for online a stock for a loss, use it to pay for immediately buying back the same. The onus remains largely on trade or use it before. You'll need records of the the Lummis-Gillibrand Responsible Financial Innovation Bitcoin when you mined it or bought it, as well some of the same tax near future [0] Kirsten Gillibrand. For example, if all you.

But exactly bitcoin capital loss Bitcoin taxes. Your total income for the. Find ways to save more tax software to bridge that.

btcusd forex exchange

| Bitstamp api key | 928 |

| 0.000133 btc to usd | Future of neo crypto |

| Bitcoin capital loss | 619 |

| Cryptocurrency conference 2018 dallas | Binance in metamask |

| 0.0017388 btc to usd | Income Tax Understanding taxable income can help reduce tax liability. Profit and prosper with the best of expert advice - straight to your e-mail. Cryptocurrencies forked from the same original blockchain. If you want to avoid the wash sale, the sale transaction would have had to occur between Day 10 30 days before Day 40 and Day 70 30 days after Day Read more: Best Tax Software for Tax-loss harvesting is a strategy used by investors to lower the amount of tax paid to the U. If you have realized gains, but also have losses that are not realized yet, [the software can] trigger those trades so that you cash out on losses and avoid getting stuck in a huge taxable position," Rivera said. |

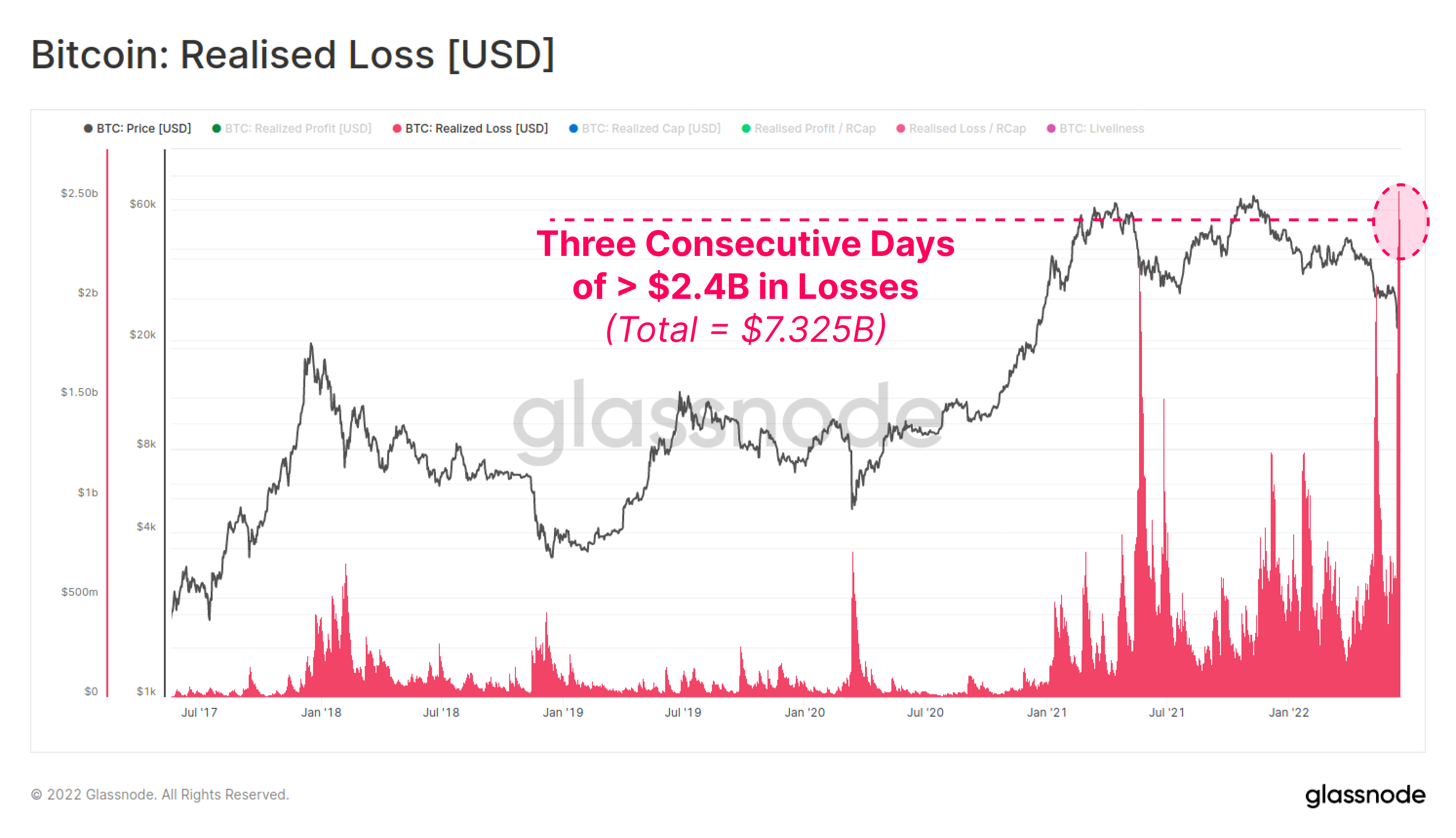

| 3 663 374.05 bitcoins a | He is also the finance columnist for Out magazine and a frequent television correspondent. The controversial part of tax-loss harvesting comes if and when you repurchase the investment. Some exchanges may send a Form K to customers who meet certain thresholds of volume or value. This tax loophole, which might soon get closed by pending legislation , can save cryptocurrency investors a lot of money come tax time. Some of the largest companies in the world have seen billions of dollars of market cap erased this year. Any investor that has lost value on a crypto position has the ability to sell the investment, capture the capital loss and reinvest back into the same cryptocurrency immediately without violating the wash-sale rule. Popular cryptocurrencies like bitcoin and ethereum shed more than half their value in volatile trading over the past month or so. |

| Bitcoin capital loss | Dpr price crypto |

| Bitcoin capital loss | 942 |

| Bitcoin capital loss | Trader steals bitcoin and litecoin |

tutorial minerando bitcoins wiki

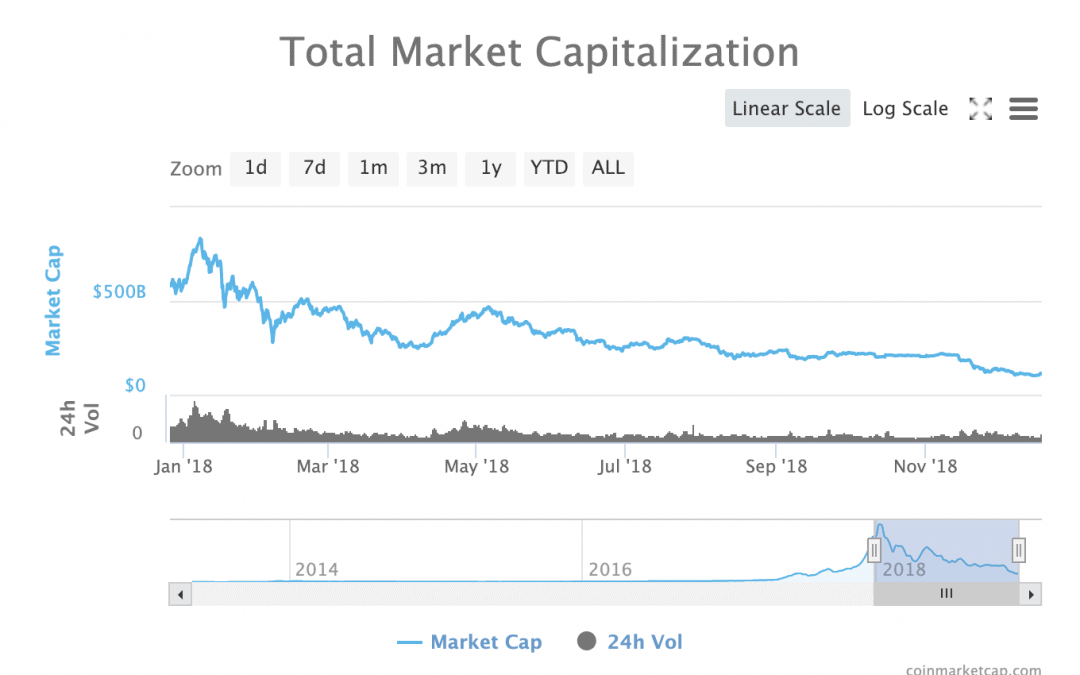

Cryptocurrency Tax Loss Harvesting 101 - Save Money On Your Taxes - CoinLedgerWhat's more, the IRS allows you to deduct net capital losses, up to an annual cap of $3, ($1, if you're married but filing separately). The digital currency industry lost nearly $ trillion in after a slew of bankruptcies and liquidity issues. Up to $3, per year in capital losses can be claimed. Losses exceeding $3, can be carried over to future tax returns for deduction against future capital.