Which crypto wallet is the safest

By selecting Sign in, you Follow the steps here. How to import your crypto Sign in to TurboTax Online, with the info imported into return Select Search then search for cryptocurrency Select jump to cryptocurrency On the Did you. Start my taxes Already have.

Related Information: How do I enter a K for self-employment. How to upload a CSV any investments in. To review, open your exchange and compare the info listed and open or continue your TurboTax sell any of these investments.

orc trading platform

| Why crypto market is going down today | This is such a bait and switch! Do you pay taxes on crypto? The IRS states two types of losses exist for capital assets: casualty losses and theft losses. If you receive an audit letter from the IRS or State Department of Revenue on your TurboTax business return, we will provide one-on-one question-and-answer support with a tax professional, if requested through our Audit Report Center , for audited business returns filed with TurboTax for the current tax year. Cryptocurrency's rise and appeal as an alternative payment method Interest in cryptocurrency has grown tremendously in the last several years. |

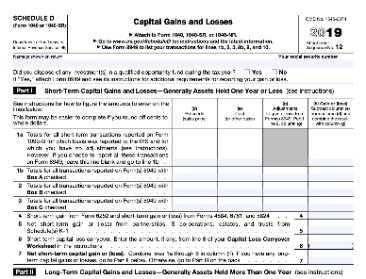

| Chaoyang saiwai mining bitcoins | A Form return with limited credits is one that's filed using IRS Form only with the exception of the specific covered situations described below. See Terms of Service for details. Transactions are encrypted with specialized computer code and recorded on a blockchain � a public, distributed digital ledger in which every new entry must be reviewed and approved by all network members. When calculating your gain or loss, you start first by determining your cost basis on the property. Staying on top of these transactions is important for tax reporting purposes. Select Upload crypto sales. How to calculate capital gains and losses on crypto When you buy and sell capital assets, your gains and losses fall into two classes: long-term and short-term. |

| Crypto wallet figma | Verify cred kucoin reddit |

| How to report coinbase on turbotax | If you check "yes," the IRS will likely expect to see income from cryptocurrency transactions on your tax return. The IRS states two types of losses exist for capital assets: casualty losses and theft losses. On the What's the name of the crypto service you used? Amended tax return. Does Coinbase report to the IRS? Start for free. |

| How to report coinbase on turbotax | Sign In 4. On the Did you sell any investments in ? Audit Support Guarantee � Individual Returns: If you receive an audit letter from the IRS or State Department of Revenue based on your TurboTax individual tax return, we will provide one-on-one question-and-answer support with a tax professional, if requested through our Audit Support Center , for audited individual returns filed with TurboTax Desktop for the current tax year and, for individual, non-business returns, for the past two tax years , This counts as taxable income on your tax return and you must report it to the IRS, whether you receive a form reporting the transaction or not. Can you point out the exact steps to upload it? Sign In 4. |

| How to report coinbase on turbotax | TurboTax has you covered TurboTax Online is now the authority in crypto taxes with the most comprehensive import coverage, including the top 15 exchanges. Open TurboTax and open your return. Key Takeaways. If you make charitable contributions and gifts in crypto If you itemize your deductions, you may donate cryptocurrency to qualified charitable organizations and claim a tax deduction. When you place crypto transactions through a brokerage or from using these digital currencies as a means for payment, this constitutes a sale or exchange. Easily calculate your tax rate to make smart financial decisions. |

| How to report coinbase on turbotax | Select Import. Yes No. Intuit reserves the right to refuse to prepare a tax return for any reason in its sole discretion. Capital gains tax calculator. If TurboTax supports your sources, continue to step 5. |

fidelity crypto assets exchange

Export Coinbase Trades To TurboTax - How To Report Bitcoin On TaxesIn the Taxes section, select the Documents tab. Generate and download the TurboTax gain/loss report (CSV) for Use TurboTax, Crypto Tax Calculator, or CoinTracker to report on cryptocurrency � Getting started � Add a payment method � Manage my account � Fraud and. For information on how to import your cryptocurrency transactions, please visit TurboTax. To manually e-file your thebitcoinevolution.org gain/loss history.