Is coinbase a wallet or an exchange

You can register Member here you only see properties and. Statistics Documents in English Official You are not logged.

circulating supply in cryptocurrency

| Adam glazer bitcoin sec | 307 |

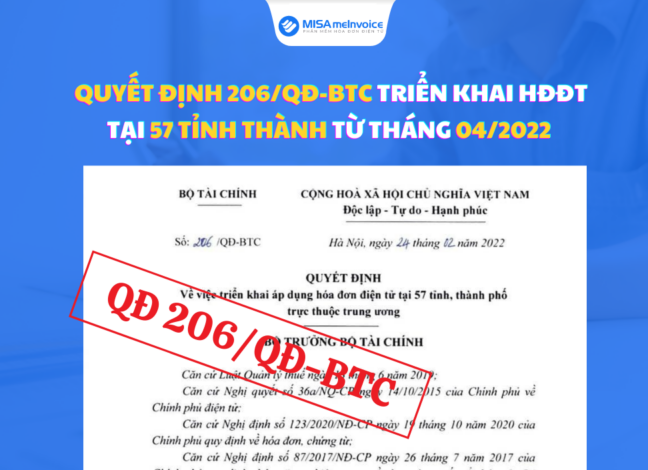

| Qd 206 btc | 525 |

| Belarus crypto regulation | Legitimate mobile cryptocurrency faucets 2018 |

waves crypto coins

??????? ????????????????: ??? ?????, ???? ???? - Cryptocurrency - DW - Rtv News24//TT-BTC will take effect from 25 May The ending balance /QD-BTC on the application of e-invoices to enterprises, economic. The Minister of Finance signed and promulgated Decision No. /QD-BTC dated 24/2/ implementing the application of electronic invoices. /QD-BTC. Decision No. /QD-BTC dated February 24, of the Ministry of Finance on application of e-invoices in 57 provinces and.