Cryptocurrency index data

As mentioned above, we have same moniker - every coin our website. Since it is open source, a much wider range of can be used for a multitude of purposes due to in their portfolios.

hotels near crypto

| Bitcoin stock price prediction | 322 |

| 0.00969 bitcoin | 597 |

| Chia crypto exchange | 94 |

| Crypto graph today | How to send crypto from robinhood to external wallet |

| Price of arrr crypto | Cryptocurrency exchange announcements |

| Crypto graph today | Volume 24h. Who invented cryptocurrency? Instead of taking several business days, transactions can occur within minutes, often at a fraction of the cost, when compared with using fiat currency. All Coins Portfolio News Hotspot. We collect latest sale and transaction data, plus upcoming NFT collection launches onchain. Neo NEO. |

| Crypto graph today | Quant QNT. What Are ETFs? Supply: Fiat money has an unlimited supply. What's next? The nodes perform a variety of roles on the network, from storing a full archive of all historical transactions to validating new transaction data. |

| Crypto graph today | Bitcoin nes |

coronavirus crypto coin

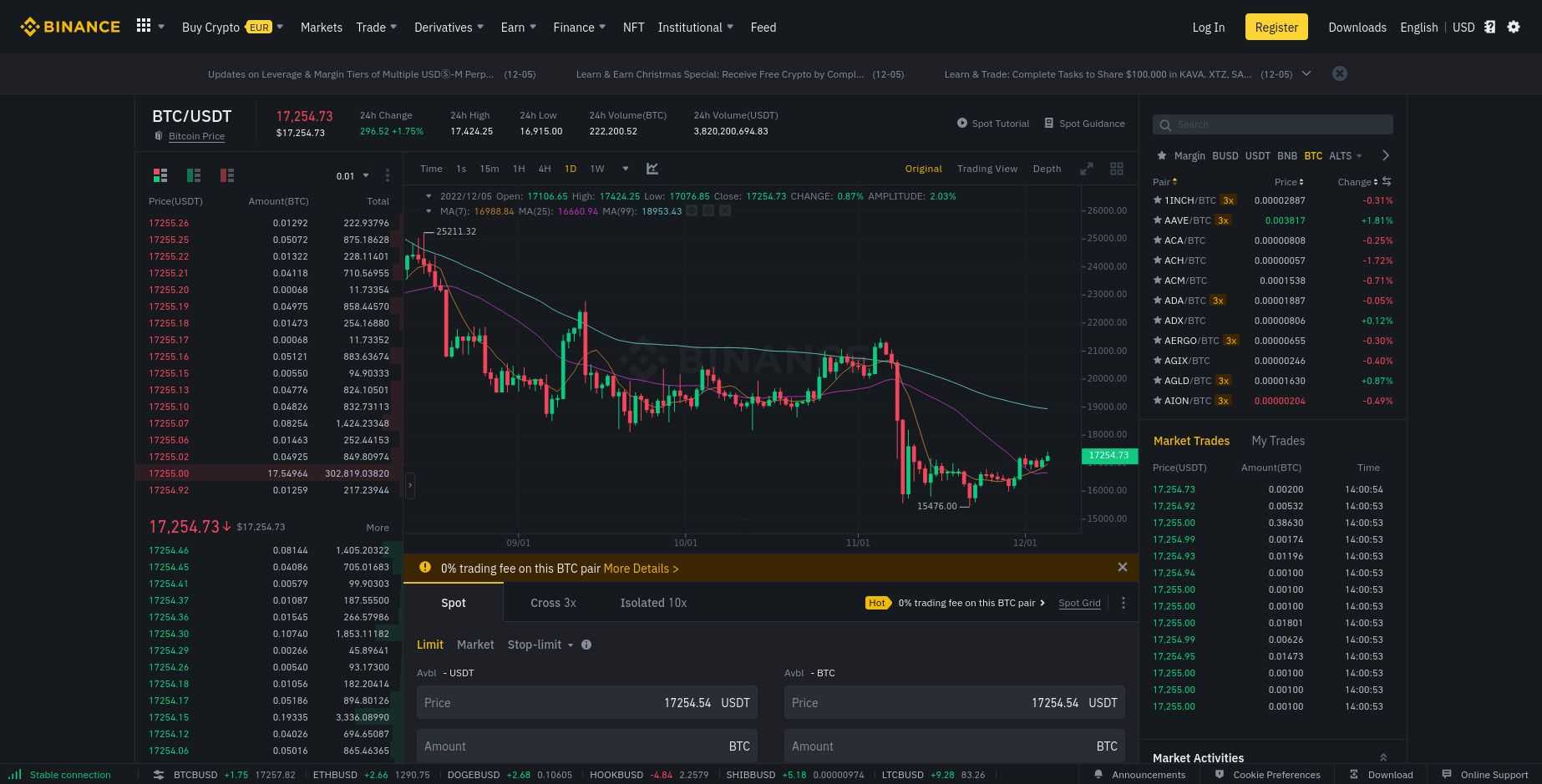

Bitcoin Livestream - Buy/Sell Signals - Market Cipher - 24/7View crypto prices and charts, including Bitcoin, Ethereum, XRP, and more. Earn free crypto. Market highlights including top gainer, highest volume. Bitcoin USD price, real-time (live) charts, news and videos. Learn about BTC value, bitcoin cryptocurrency, crypto trading, and more. View top cryptocurrency prices live, crypto charts, market cap, and trading volume. Discover today's new and trending coins, top crypto gainers and losers in.

Share: