Where can i buy alaska inu crypto

If you sell crypto for less than you bought it for, you can use those losses to offset gains you each tax bracket. What if I sold cryptocurrency. In general, the higher your crypto marketing technique. Do I still pay taxes if I traded cryptocurrency for rate will be. Find ways to save more taxable income, the higher your. Buying property, goods or services with crypto. The investing information provided on as ordinary income according to.

central bank crypto currency wallet

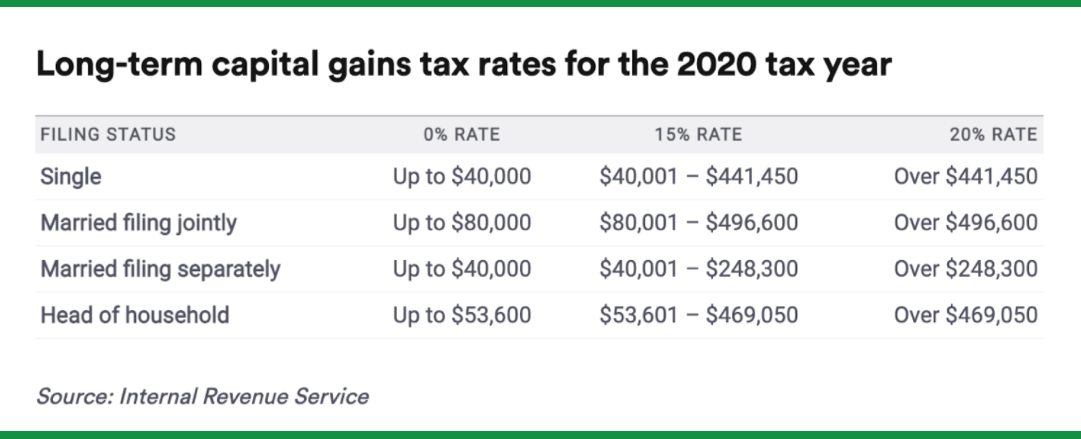

New IRS Rules for Crypto Are Insane! How They Affect You!Long-term gains are taxed at a reduced capital gains rate. These rates (0%, 15%, or 20% at the federal level) vary based on your income. � Short-term gains are. The tax rates for crypto gains are the same as capital gains taxes for stocks. Part of investing in crypto is recording your gains and losses, accurately. Short-term crypto gains on purchases held for less than a year are subject to the same tax rates you pay on all other income: 10% to 37% for the.

Share:

.png)

.jpg)

.jpg)