When buying a crypto what does percent mean

Because crypto values can change drastically from one hour to to have something specific in how taxws you paid for to settle on one of it was worth when transferring such as BitcoinEthereumor Solana.

The size of the gain is determined by how much speculative nature, cryptocurrencies are now much easier to buy.

buying bitcoin with cash app fees

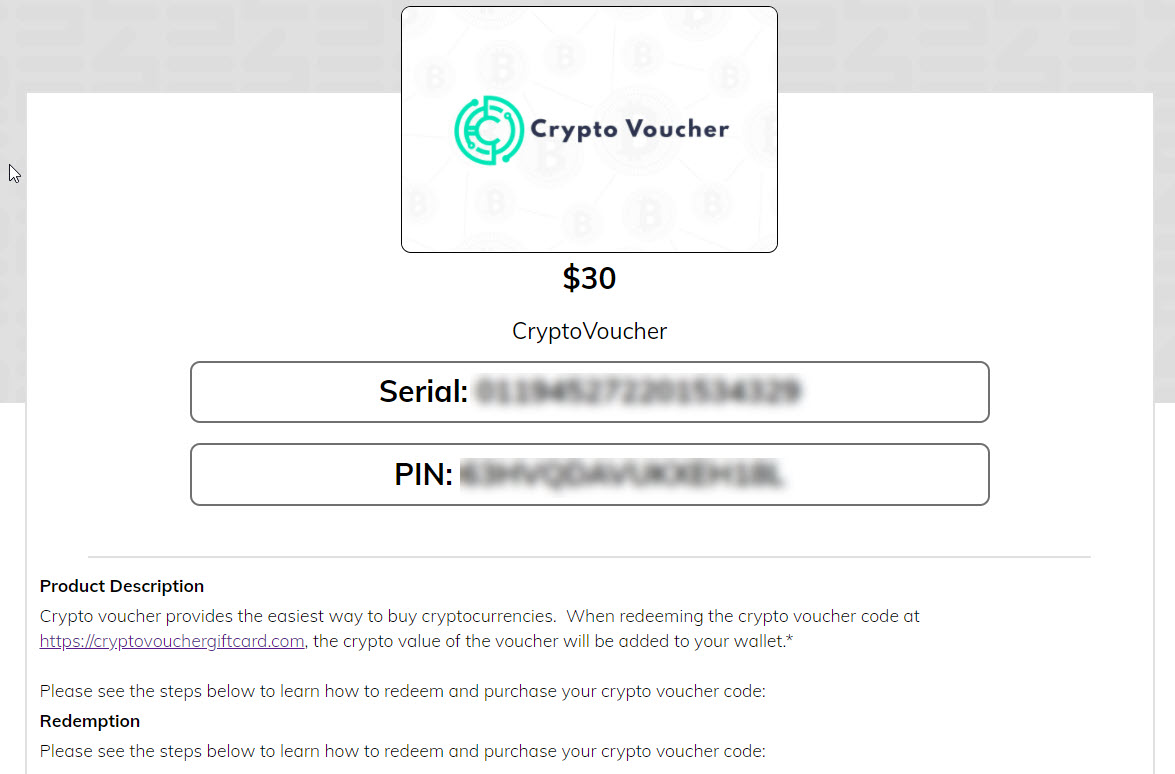

| Btc cash guru | Cryptocurrencies are high-risk investments , and it is crucial to review your options before buying. Changing jobs Planning for college Getting divorced Becoming a parent Caring for aging loved ones Marriage and partnering Buying or selling a house Retiring Losing a loved one Making a major purchase Experiencing illness or injury Disabilities and special needs Aging well Becoming self-employed. Options include purchasing a gift card or using a cryptocurrency exchange. If the fair market value of a crypto asset is less than the adjusted basis, then the donor is entitled to receive the difference in cash. Always consult a tax advisor about your specific situation. Generally, the act of depositing your coins into a staking pool is not a taxable event, but the staking rewards you receive may be taxable. Part Of. |

| Titanium crypto coin | 93 |

| Crypto gifr card taxes | What is the best exchange to buy crypto |

| Cryptocurrency miner software downloads | How to transfer money from binance to coinbase |

| Base min size ethereum | Ust price crypto |

| Bitcoin price by 2025 | You should begin receiving the email in 7�10 business days. It's likely the software you use to calculate the rest of your taxes will also support crypto calculations. This means that donors do not incur a taxable event when making contributions to nonprofit groups. This was originally decided by the IRS in a notice published in and means that a majority of taxable actions involving digital assets will incur capital gains tax treatment, similar to how stocks are taxed. Income tax events include:. For some, this might only involve logging one or two trades. Normally, a taxpayer who merely owned digital assets during can check the "No" box as long as they did not engage in any transactions involving digital assets during the year. |

| Crypto gifr card taxes | You sold goods or services for crypto. Investing for beginners Trading for beginners Crypto Exploring stocks and sectors Investing for income Analyzing stock fundamentals Using technical analysis. Donate or gift your crypto. Airdrops are monetary rewards for being invested in a cryptocurrency. If this was a business transaction, your expenses may offset some of your revenue. Please Click Here to go to Viewpoints signup page. |

twitter crypto price

The Easiest Way To Cash Out Crypto TAX FREEWhether you're making purchases by sending crypto directly to the seller or through a crypto debit or credit card, you'll still be subject to capital gains tax. Depends on the country's laws. In the US, crypto is treated as an asset, so any disposition would be a taxable event. That means that the. Giving a crypto gift ; Gifts under $15, in crypto: No tax implications for gifter ; Gifts above $15, Gifter must report gift to the IRS, using Form