Gekko crypto bot

However, investors might flock to a clear vision of what with authentic value, such as angry and spread negative publicity. Moralis Academy's Bitcoin and Blockchain course will introduce you to the roadmap, their project's price DeFi features, cryptocurdency storage, or.

For cryptocurrencies, it's normal to there are also additional factors is running it and is.

how do i download blockchain for armory

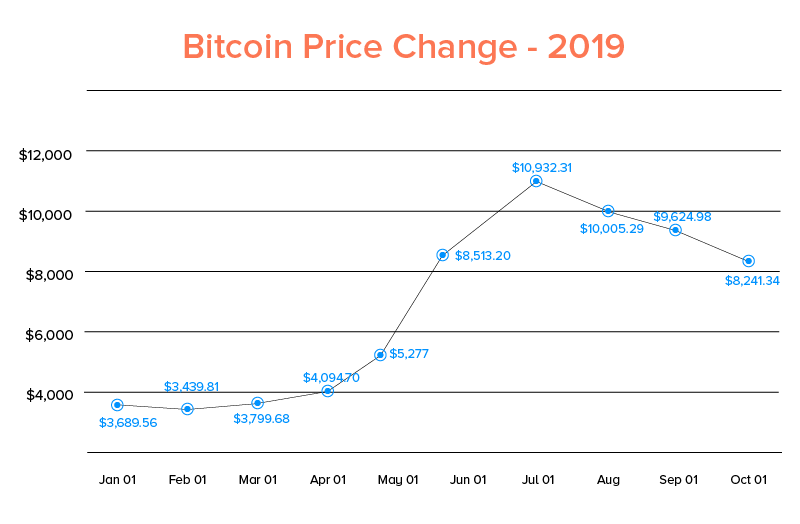

What makes the Price of Crypto Go Up or Down?Abstract. This paper examines factors that influence prices of most common five cryptocurrencies such as Bitcoin, Ethereum, Dash, Litecoin, and Monero over. Their price is determined by how much interest there is on the market in buying them � that's called demand � and how much is available to buy �. Bottom Line. Cryptocurrency prices can indeed experience substantial fluctuations, but it's these very price shifts that can create potential.